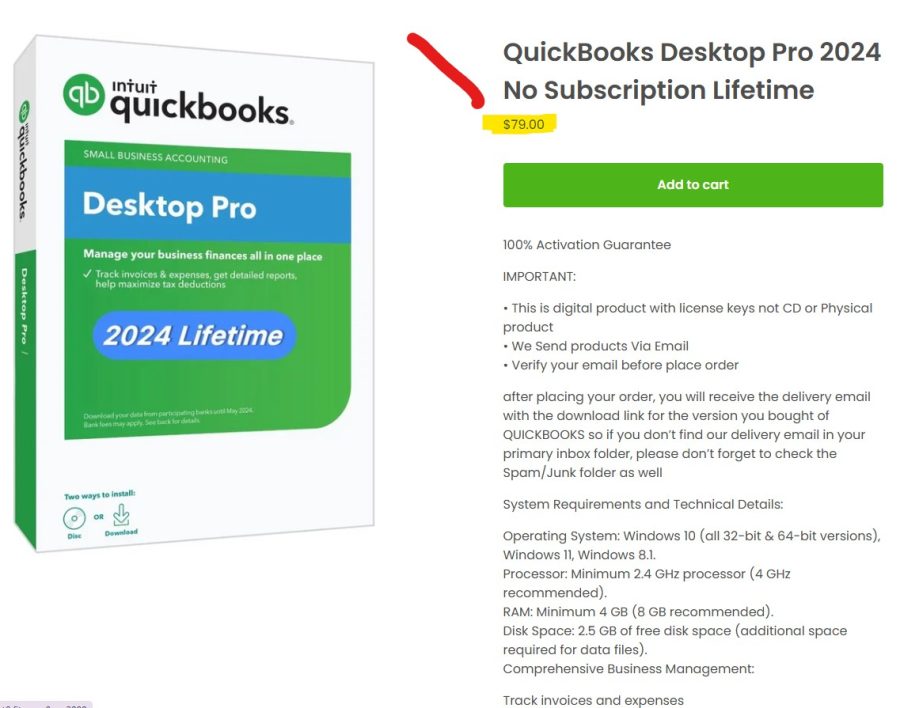

Click Here to Order Now

Only $79

Category: INVESTOR BOOKS

CASH From ME account – how to use properly (7min video)

Update IRS Tax Proposal on 100% Depreciation from Mike Grinnan CPA

Proposed Rules Address 100-Percent Depreciation Deduction

Proposed regulations address the new 100-percent depreciation deduction that allows businesses to write off most depreciable business assets in the year they are placed in service.

Background

The Tax Cuts and Jobs Act (TCJA) ( P.L. 115-97) amended Code Sec. 168(k) to increase the percentage of the additional first year depreciation deduction from 50 percent to 100 percent for property acquired after September 27, 2017. It also expanded the property eligible for the additional first year depreciation to include certain used depreciable property and certain film, television, or live theatrical productions.

Generally, the 100-percent depreciation deduction generally applies to depreciable business assets with a recovery period of 20 years or less and certain other property. Such assets include in part machinery, equipment, computers, appliances, and furniture.

The proposed regulations provide guidance on what property qualifies for the deduction, and rules for qualified film, television, live theatrical productions and certain plants.

VENDORS – How to Put All Notes on a Page in Chronological Order

QUESTION:

Mike, I keep notes on my tenants and vendors. Notes the one they can’t see. I would like to print off all the notes I have for 1 vendor. How do I do this?

This would be great for tenants also. Again, this is for the Notes they cannot see.

Thanks,

A. -Texas

How to Enter Home Depot Invoice

How to Enter a “Revolving Account” Invoice

This is used for any vendor allowing you to buy stuff on your account

and then pay when they send you your monthly statement

This is used for any vendor allowing you to buy stuff on your account

and then pay when they send you your monthly statement

Examples:

Home Depot account, Lowe’s account, Menard’s, Paint Store, Local Hardware, etc.

3 minute video

IRS 2020 Inflation Adjustments for Pension Plans, Retirement Accounts by Mike Grinnan CPA

The IRS has released the 2020 cost-of-living adjustments (COLAs) for pension plan dollar limitations, and other retirement-related provisions.

Highlights of 2020 Changes

IRA Contribution Limits:

- The annual limit on contributions to an IRA remains unchanged at $6,000.

- For individuals age 50 and over, the IRA “catch-up” contribution limit remains $1,000 (this limit is not subject to an annual COLA adjustment).

The contribution limit for employees who take part in 401(k) plans, 403(b) plans, most 457 plans, and the federal government’s Thrift Savings Plan, has increased to

- $19,500

- Employees age 50 and over who participate in these plans can make a “catch-up” contribution for 2020 of up to $6,500.

Escrowed Funds Refund Overpayment on Reserves Held by Lender

QUESTION from Jared:

Hi Mike,

I am absolutely loving the videos and system you have created with Investor Book’s Pro. I successfully have caught up my 2019 books using the system and am using my “rainy weekends” as you mention in the Quick Start videos to fill in previous years (to determine the cost basis of my properties.. and I’m super analytical and want my numbers to match). I’m making my way back to 2016 and almost have everything wrapped up.

For one of my properties I purchased subject to the existing mortgage, the mortgage company escrows taxes and insurance. I cancelled the seller’s insurance and purchased my own at the time of closing. A month after I purchased the property, a disbursement went out of the escrow account to my insurance company. A few days later, the seller’s previous insurance company sent the refunded insurance money to the mortgage company. The mortgage company added the funds to the escrow balance.

I’m not sure where what account to choose in the Escrow register since it wasn’t originally my funds. Initially I thought I would put it in the fixed asset for the property but the money doesn’t go to benefit the property but rather it is sitting in the escrow account. Any advice on how to best enter this? One other way I thought to do is add the refund to the starting escrow balance and call it good. The numbers would work and it wouldn’t impact any of my company financials.

Jared

ARMs – Adjustable Rate Mortgages from A to Z

How to Enter Cash Purchase Using a Silent Private Lender

I borrowed money from a private lender, put that in my account and then paid cash at closing.

1031 Tax Deferred Exchanges

How to enter properly is in your Investor Books Manual on Pages 173 thru 186

Page 173

Used by Investors to avoid paying Capital Gains Tax Now, you can defer it.

There are many variations involving 1031s including partials.

For KISS method purposes, example used will be simple and traditional.

• Investor has a house used for a rental for 10 years

• Investor purchased house 10 years ago for 50k

• Ballpark depreciation is 51,500 per year, reducing cost to 35k

• Investor can sell rental house for 140k resulting in 105k capital gain

• At 30% tax rate, could mean over 33k in Tax owed.

• Using the 1031 procedure PROPERLY, you could keep the 33k and roll it over into another like kind investment (1 or more rental houses)