CAUTION: If you have already purchased QuickBooks Pro Desktop for PCs, Intuit is now forcing us to pay an annual licensing fee.

Intuit stopped selling the QuickBooks Pro Desktop for PC software. If you need to start from scratch, I highly recommend to purchase Quicken Deluxe.

Here’s a recent question received from a 20 year user of Investor Books and Tenant Tracking.

QUESTION: Hi Mike,

I took one of your RE course about 20 years ago and purchased Investor Books and Tenant Tracking. QuickBooks has since gone to a subscription model and their latest cost is $999 per year. That is getting excessive. Have you migrated your system to QuickBooks online? Just curious how you are handling things? Just paying the exorbitant price?

Thanks, Patrick

ANSWER: Patrick,

Investor Books is a company file using QB Pro Desktop for PCs

Tenant Tracking is a company file using QB Pro Desktop for PCs

it's very ugly what QB did to all of us long time users.

after much research and meetings with Intuit, here's my recommendation:

For me and my business, I am staying with QB PRO Desktop for PCs and paying an annual licensing fee.

- this allows me to have as many company files as I want.

--- (Investor Books, Tenant Tracking, Education Company, TrusteeServicesUSA.com, and QuickBooksForInvestors.com)

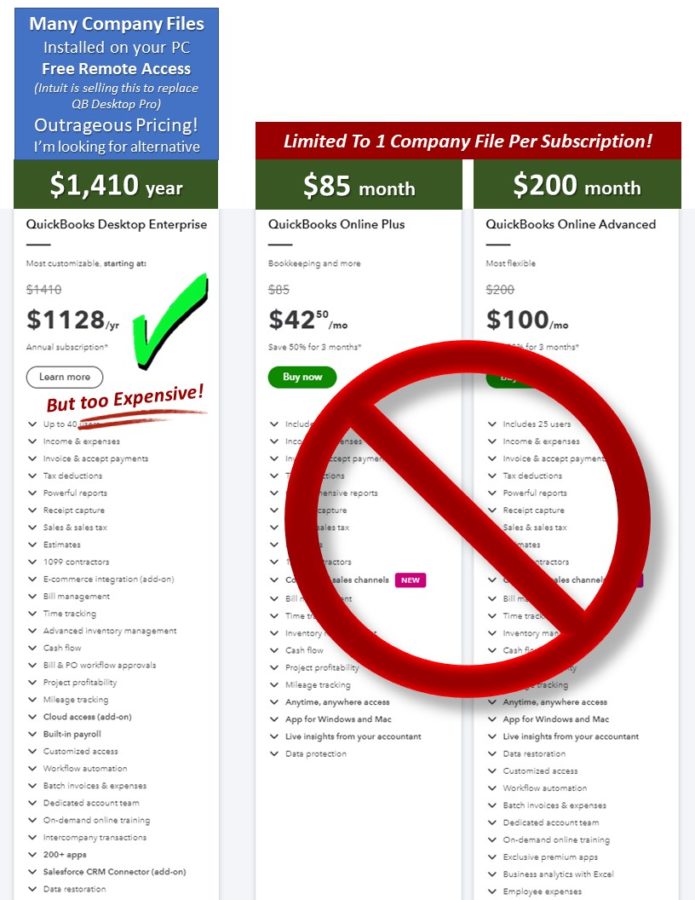

I do NOT recommend using QB online because it will cost you a minimum of $160 per month

- Why? because online subscription allows only 1 company file per subscription.

- Investor Books would cost you $80monthly

- Tenant Tracking would cost you $80 monthly

- BUT the BIGGEST Reason, is the online versions are totally different and you can not upload your company file without having a boatload of errors that Intuit will blame it on you.

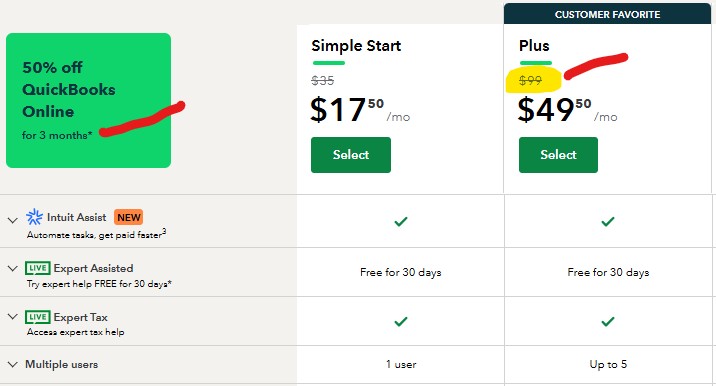

if the annual license is not up your alley, the best alternative is Quicken, the Deluxe, top of line version.

i guess if me and you owned Intuit and QB, we would like to see customers required to pay an annual licensing fee.

just curious Patrick, what version of QB Pro Desktop for PCs are you using?