Click Here to Order Now

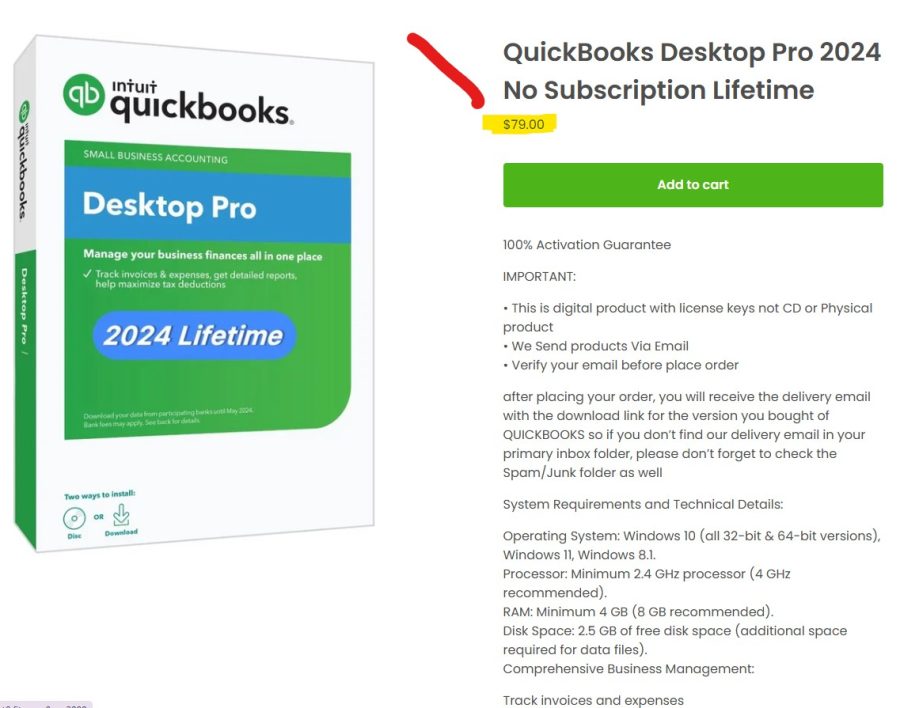

Only $79

Category: Troubleshoot

How To HUD Settlement Statements and Refi’s Question

QUESTION from Becky:

Hi Mike,

I just joined as an annual member today and have a few questions. I’m trying to get through as many videos as possible as quickly as possible in order to get the books done for a client of mine who has 25 LLCs, each with multiple rental properties and properties he has bought and sold. Unfortunately I don’t have time to watch the full series as I am in a major crunch at the moment.

I’m specifically looking for videos that will explain how to enter a HUD from a purchase when there is a loan involved and a line item referring to “improvement escrow account” as well as “down payment reserve account”

Also, what I am seeing him do on a regular basis, is take out a loan with the line items mentioned above, and then refinance a few months later. So i am looking for the refinance side of that as well.

Could you point me in the right direction on where to find this information?

Thanks!

Free Training – POWER LUNCH “Chalk Talks”

QuickBooks for Real Estate Flips How To Enter Repairs

QUESTION from Steve:

Hello Mike,

I looked through the Investor Books Manual and did not see this …

When doing a flip, the repairs will be a capital expense versus an ordinary expense.

How are you booking the repairs?

Steve

My Reports Don’t Look Right In QuickBooks Q&A

QUESTION from Sharon:

Hi Mike

I am the owner of your Investor Books PRO System software and have attended one of your seminars in KY a few years ago. I did have a girl doing my books who is no longer helping me and I am STUCK! I have a couple of questions that I can not seem to find the answer…

- How do I get an accurate report on what I actually took in on a property? I can go to income by property report – and that’s fine – but when I compare that to my the income detail report – the numbers don’t match? What I billed out isn’t important – it is what I actually took in (by property) that I am looking for?

- Once I can get my hands on the real amount of money I took in for each property – how do I take that income and put it into Investor books so that I can see what my real bottom line is – ie income vs expenses…

I would appreciate it if you could point me in the right direction….

Thank you

Sharon B.